In the context of the health crisis caused by COVID-19, multilatinas companies went through the same stages as their global counterparts: reaction to the crisis, temporary adaptation, and planning towards the so-called “new normal”. However, that process took place without solid rescue plans such as those carried out in the United States and Europe. In the United States, the Trump and Biden administrations injected billions of dollars into the economy to keep it afloat and protect families, in the European Union the bill exceeded a billion euros.

Introduction

Multilatinas in the COVID-19 context

In percentage terms, of the countries in the region, only Brazil is among the countries that have invested the most share of their GDP in combating the effects of the pandemic.

Percentage of GDP that countries invested to address the costs of the pandemic

Before the pandemic: the experience of uncertainty

Multilatinas are the star companies of internationalization in the region, marked by special conditions. Latin America has always been a less predictable region than the United States or Europe. To give recent examples, countries such as Brazil, Argentina or Venezuela went through the supercycle of commodities at the end of the first decade of the 21st century, to enter into periods of crisis in the course of the second.

In this volatility, the successful companies that make up the world of multilatinas were forged, and continue to be forged. Companies that, to a greater or lesser extent, learned to be flexible, a key-value to face the challenges left by 2020. The strength of their businesses under these conditions led to resilient, innovative, and agile companies to adapt.

Before the pandemic, the situation of multilatinas could be summarized in the following characteristics:

- The internationalization of multilatinas was progressing significantly.

- The focus was to expand into culturally similar regions.

- Businesses formed or grew in times of local or global crises.

And how are multilatinas perceived in public opinion?

To understand from a social perspective how multilatinas companies are understood and discussed, we did an analysis using a proprietary system called Data Analytics Suite, focused on the study of social conversations that mentioned one or more of the world’s most important multilatinas companies.

The datasheet of the study, subdivided into communities and grouped into nodes by country, was as follows:

- We analyzed 7,284,170 messages.

- We studied 2,278,663 profiles.

- The time frame of the study was from January 1st to June 30th of 2021.

- Sources: open networks and public pages.

This study, which is based on an analysis of the territories and communities with greater prominence in the conversation and results in a sociogram of what is said about multilatinas, was carried out through segmentation according to the following three dimensions:

- Theme: by applying semantic analysis techniques to extract the main conversation sub-territories. In some parts of the analysis, the analysis of the territory related to the main sustainable development goals (as they refer to the 8 main groups of SDG objectives defined in the 2030 Agenda of the UN).

- Sector: by sectors of activity. Segmentation and aggregation of results by the economic sectors to which the companies belong

- Corporate: conversation of corporate accounts versus the conversation of the rest of society. Differential analysis of the conversation generated by the company’s corporate accounts versus the conversation of the rest of the citizens.

What is the DAS?

The Data Analytics Suite, called DAS, is an LLYC big data information analysis system for establishing prediction models.

Conversation insights

In this sense, the study not only sheds light on where, who and what is usually talked about, but also analyzes the interactions, discursive lines and correlation between allied communities, when talking about multilatinas companies. The data reveals an important concentration of conversation, both at a geographical and corporate level.

Here are the key insights:

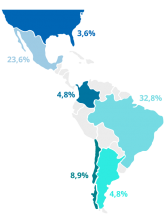

- The conversation about multilatinas is strongly concentrated in 3 or 4 countries: 65% of the top 100 multilatinas come from three countries: Brazil ( ), Mexico ( ), and Chile ( ). If we add Colombia ( ) or Argentina ( ), these 4 countries contribute 70% of the companies to the top 100 multilatinas. While population size plays a role in the distribution of conversation, there are large and medium-sized markets that do not influence the issue. Almost 2 out of 3 talks about multilatinas take place in Brazil and Mexico.

- 63% of conversation about the most important multilatinas revolves around 10 companies: 6this corporate concentration of conversation separates those that have managed to penetrate public opinion much more, either for their communication efforts or dominance in the industry.

- The multilatinas that have the greatest prominence in the conversation are those that belong to the sectors ‘Energy’ and ‘Food and drinks’: they represent almost one in two messages (48.4%), given the sensitivity of their business or their impact on the day-to-day lives of people. However, there are areas of opportunity in other industries to encourage conversation.

- 68% of the conversation about multilatinas companies takes place in their country of origin: dependency on their root market remains high. Although business internationalization has progressed at its own pace, the internationalization of its conversation has a way to go in the region. In the case of Brazil, because of the language barrier, this dependency rises to 82%.

- On the other hand, the United States tends to appear as the second market for several multilatinas companies, so on average, the multilatinas company tends to seek or find a position thereafter its country of origin.

Multilatinas that concentrate most of the conversation

Conversation volume by sectors (global)

Conversation on multilatinas at the global level

Other insights of the conversation

- Only 2.2% of the talks on multilatinas are associated with environmental causes, and more than half (56%) take place in Mexico.

- 1.1% of the conversations in the multilatinas territory refer to factors related to the digital transformation, with the FINANCE sector making the greatest contribution, with almost 1 of every 5 messages of the total.

- 2 out of 5 messages in the “data” territory, highlight the link between data analysis and artificial intelligence.

- The group of sustainable development goals (SDGs) related to economic growth are the ones most linked to multilatinas: almost 1 in 3 conversations in the SDG territory refer to economic growth.

- ‘Automotive’, ‘Retail’ and ‘Energy’ are the three multilatinas sectors that give less prominence in their corporate conversation to the link between their activity and economic growth.

- 1 out of 5 SDG talks (18.9%) has to do with “social justice” issues and 2 out of 3 (65.4%) mention corruption as a cause.

- ‘Energy’ and Industry’ are the two multilatinas business sectors that dominate more than 50% of the talks on the ‘Education” SDG goal (54.6%).

- Consumer goods ‘with a +160% and ‘Finances’ with a +130% conversation volume, compared to the average, are the two sectors that make the greatest effort in their corporate communication to position themselves in the territory of education.

The multilatinas that are evolving the best

Understanding this economic and social context, the questions are: how have multilatinas surfed the crisis and redefined themselves? How are they trying to penetrate public opinion? How have they adapted their business models or developed initiatives according to what their environments demand?

From the role of CEO as the company’s central ambassador to a refocusing on attracting talent, there are global trends that are permeating the multilatinas business system in the dispute to better connect with their audiences. Below we analyze those trends and the multilatinas that are adapting the best.

Download the report

ONE

Leading Beyond the Business

This concept expresses a version of the top executives of companies that function as key ambassadors…

TWO

Automating the generation

of value

Without a doubt, the COVID-19 pandemic has had major impacts not only on health, but has accelerated…

THREE

Establishing prediction

models

Beyond the debate on data privacy, what big data use tells us is that any public information…

FOUR

Brands with purpose

The new reality of the business world has accelerated the internalization of a concept that has acquired great importance today: the best…

FIVE

Magnetism with talent

Talent is a continually evolving point of discussion. In parallel with social demands, recruitment, retention…

SIX

Those who doubled the bet

The COVID-19 in Latin America has particular characteristics common among the countries of the region…

SEVEN

Expanding networks

Interest groups refer to groups of people who are affected by a company’s operations and performance…

2.

THE MULTILATINA BRAND: A MARKET OF OPPORTUNITIES

In addition to the challenges and trends that multilatinas have, which only differ from global companies because of…

3.

CONCLUSIONS

After analyzing multilatinas and their business performance from a glocal perspective, starting from global trends to…